Telecom operators need to leverage eSIM as part of their overall solution or lose control

Telecom operators need to collaborate with OEMs and eSIM [embedded SIM] management companies or they will lose control over the market and the revenue share, industry experts said.

“OEMs started reaching out to operators, after Apple launched eSIM iPhones, and told them that they need to collaborate with them or lose the market. Today, it is eSIM and tomorrow it is going to be iSIM [integrated SIM] and they [OEMs and eSIM management companies] will have more control,” Satyajit Sinha, Research Analyst at Counterpoint Research, told TechRadar Pro Middle East.

With eSIM management companies and OEMs collaborating and with cloud-native 5G coming into the picture, he said that OEMs will have a bigger share of the revenue percentage than telecom operators.

Majority of eSIM-based devices will have a hardware chip-based eSIM solution until 2025 and after that; the industry is going to see a rise in the adoption of integrated SIM-based solutions (iSIM).

Now, modem and SIM card are under one roof for eSIM technology but in iSIM, it is going to be embedded into the SoC.

Sinha said that GMSA has not yet approved iSIM and is going to announce the definition of iSIM soon.

“ARM and Qualcomm have started adopting iSIM. IoT was the first adopter of eSIM and they will be the first to adopt iSIM,” he said.

Qualcomm became the first to launch iSIM-enabled SoC with 855 chip.

Traditionally, the SIM market is controlled by telecom operators and they had full control but telcos are now losing their hold with eSIM.

“Some operators are rigid to adopt this technology and eSIM management companies went directly to the orchestration companies like Ericsson and MVNOs, instead of telecom operators,” he said.

Saudi Araba’s STC has their own eSIM management company with GSMA certification and they don’t need to go to the eSIM management companies.

Smartphones to drive volume

Yaarob Al Sayegh, Virgin Mobile’s CEO for Saudi Arabia, said that they have seen an increase in eSIM adoption as it was an ideal solution during the pandemic and post-Covid, it is going to be encouraging.

“We have a good adoption of high-end smartphones with eSIM facility in the market. Traditional telcos were rigid to adopt eSIM but as we are an MVNO, it is an opportunity. Today, eSIM has a share of about 20% of our total SIM sales. Telcos need to collaborate with OEMs and eSIM management companies to give a better experience to customers and it is happening today,” he said.

Virgin Mobile is operating as a mobile virtual network operator in Saudi Arabia since 2014, in partnership with STC.

Mea Thompson, Director of Partnerships at world’s first eSIM store for travellers - Airalo, said that some operators might see eSIM as disruptive and others might see it as a major opportunity for digital transformation.

“eSIM discussions with telecom operators have matured and especially in the last four months due to Covid-19. Operators, which were not ready for eSIM last year, are eager to push it now and are knocking on our doors to start promoting and pushing their sellers globally.”

She said that OEMs can produce thinner and lighter devices by removing the SIM tray and with Motorola launching the eSIM-only phone - Moto Razr, the eSIM is going to be back in action.

“5G, IoT and eSIM will bring in new business and revenue models for MNOs and MVNOs,” she said.

According to Thompson, only 11% of smartphone users are using eSIM compatible device today amid one out of five smartphones shipped in 2020 are eSIM compatible devices, which translates to 400m install base this year.

Sinha said that eSIM is seeing a slow rate of adoption from the consumer side in the Gulf region as the functionality is introduced only on high-end smartphones such as Google and Apple.

However, it is largely being used for the internet of things (IoT) and machine-to-machine (M2M) solutions in the region.

Compared to other regions, he said that adoption of eSIM is still a niche in the Gulf region but will catch up by 2022.

In the next five years, Sinha said that smartphones will drive most of the volume in consumer IoT.

Travellers to add value

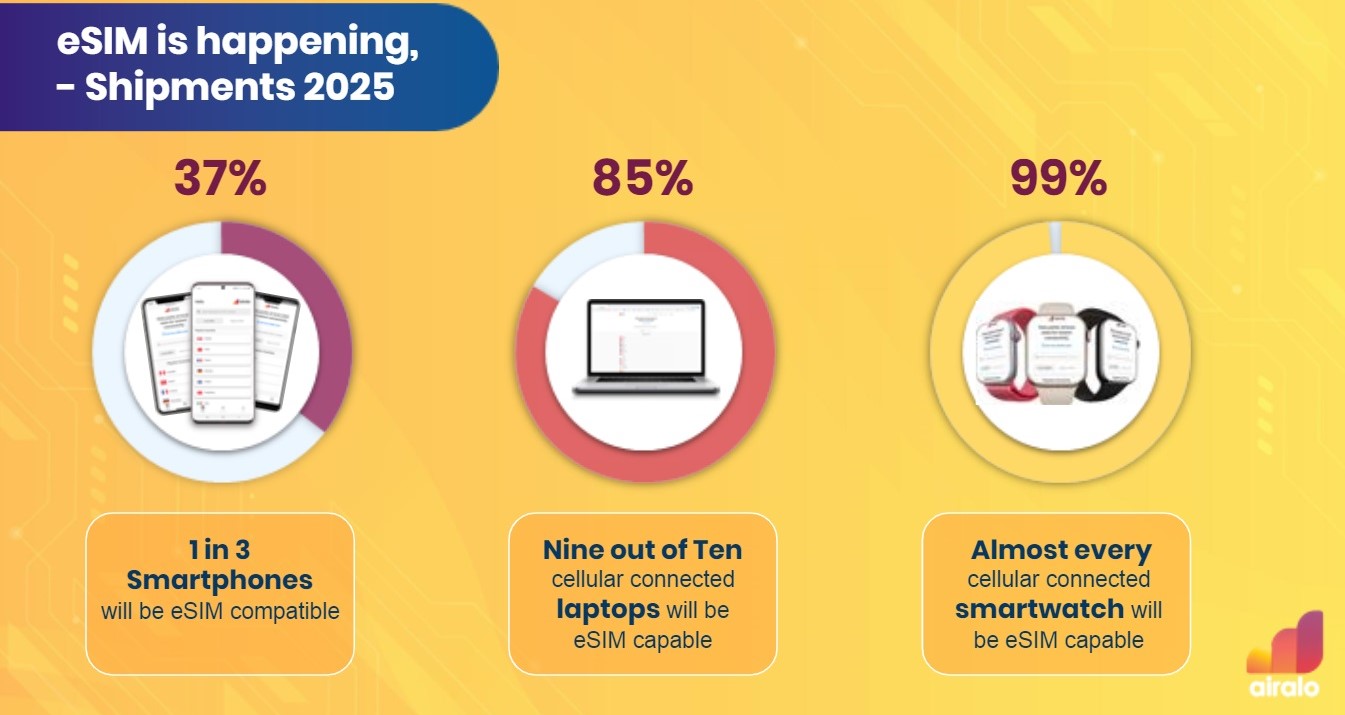

“By the end of 2025, we will have 4.3b of devices with eSIM installed. Out of that, smartphones will contribute to 31%. In smartwatches, currently, Apple and Samsung are supplying with eSIM facilities but by 2025, every smartwatch will be eSIM enabled and nine out of 10 laptops will have eSIM option,” Sinha said.

Quoting an Ericsson report, Thompson said that 63% of smartphone users are interested in connecting their laptops with eSIMs while 45% are interested in connecting tablets with eSIMs.

Sinha said that when Qualcomm and other chipset companies launch eSIM-enabled chips into the low-tier phones, then the demand for eSIM will take off.

He said that eSIM not only offers great benefits for consumers and enterprise customers to seamlessly choose, activate, connect and manage connectivity on their devices but also significantly reduce the SIM distribution and activation costs for telecom operators and fuel the potential to generate higher roaming revenues.

Even though travelling has been curtailed during Covid-19, Sinha said that travel revenue is going to continue and reach $4.6b by 2025.

Thompson said that there will be changes in the travel industry and in eSIM adoption after the pandemic.

“Around 50% of travellers are silent roamers and operators can add more travellers and locals onboard and win subscribers. I see a win-win situation for everyone by looking at the revenue streams by combing travellers and eSIM.

“We see Maritime industry, such as workers and sailors, can now be connected to their families and without having to worry about roaming charges and getting to the shore to purchase local SIMs. We also see a major interest from leisure travellers without worrying about purchasing the best local SIM cards,” she said.

The current biggest roadblock, according to Sinha, is the higher price of NOR flash, mainly due to increased demand for eSIM.

NOR flash is mostly used for code execution while NAND flash is mostly used for data storage. NOR flash is most often used in mobile phones, scientific instruments and medical devices.

from TechRadar - All the latest technology news https://ift.tt/2Wjx1Lv

https://ift.tt/2X0fHbT

No comments